October 2, 2024 Trading notes

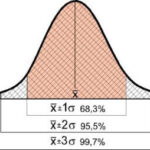

The results clearly showed that trend-following strategies applied to equities do indeed provide a decidedly positive mathematical expectation of profits, an essential element of an “effective” trading system.

Is trend following also effective on equities ?

A rather dated study, published back in 2009, but really quite interesting and most importantly I think still relevant.

Over the years, many proprietary traders and global macro hedge funds have successfully used various trend-following methods to trade profitably in the futures markets.

However, very little research has been published on trend-following strategies applied to stocks.

Is it reasonable to assume that trend following “works” only for futures but not for stocks ?

In the attached paper, an exclusively long trend following strategy is tested on a complete database of U.S. stocks, previously adjusted for corporate actions (ex-dividends, dividends paid in shares, splits, reverse stock splits).

Stocks were selected based on the following predetermined characteristics

All “delisted” companies were included to account for survival bias.

Realistic estimates of transaction costs (slippage and fees) were taken into account.

Prior filters were used to limit (hypothetical) trading to securities that were sufficiently liquid to be traded at the time of the transaction.

The results clearly showed that trend-following strategies applied to equities do indeed offer a decidedly positive mathematical expectation of profits, an essential element of an “effective” trading system.

Short selling strategies were never considered in this study.

The reasons for this are quite obvious.

The short seller first instructs his broker to sell XYZ stock at a predetermined price.

In reality, the short seller usually simply borrows XYZ stock directly from the broker.

The broker usually already owns XYZ stock in the stock portfolios of pension funds, mutual funds, or other investors (institutional or otherwise).

If not, the short seller has a limited amount of time (usually 3 days) to find someone who will lend him the XYZ stock.

In the event (rare, but it can happen) that the short seller fails to meet this requirement, the broker will execute a buy-in.

That is, the forced repurchase (by the close of the market in which XYZ stock is listed) of the previously opened short position.

The lender of XYZ stock can demand its return at any time, so there is no way to know when or if a short seller will be subject to a forced buy-in.

Thus, there is no reliable way to determine which stocks would realistically have been shortable in the past.

In addition, compared to long-term trend-following, short selling offers a very limited mathematical expectation: the price of a stock can fall a maximum of 100 percent (as opposed to futures, which can fall indefinitely even below zero due to the phenomenon of so-called “contango” ).

Conversely, it can rise infinitely.

In addition, only stocks with a value of $15 were considered as the “minimum price” in this study, a decision based on the fact that low-priced stocks tend to have relatively high statistical volatility and little institutional following.