January 15, 2025 Trading notes

What goes around comes around

What goes up must come down

Now who’s cryin’, desirin’ to come back to me

What goes around comes around

What goes up must come down

Now who’s cryin, desirin’, to come back“Bob Marley – What goes around comes around”

Like a movie. A real free fall

Sometimes life unfolds like a movie.

And sometimes even the ending is very similar.

Certain episodes can change a person’s entire career.

And sometimes your life.

This was one of them.

June 12, 2012

For every action there is an equal and opposite reaction

Despite the peg set at 1.20 and guaranteed sine die by the Swiss National Bank, I have a heavily bearish position on the EUR/CHF exchange rate.

In contrast, 99.9 percent of financial traders on foreign exchange at Forex are bullish.

In my view, this is a highly dangerous situation that can lead to a sudden increase in volatility.

In fact, the majority of financial traders, particularly the small ones, do not have sufficient funds to cover their losses in case of a sudden removal of the peg.

The ratio of bullish to bearish is too unbalanced.

In addition, all institutional traders have automatic stop losses below 1.20.

Why is my opinion so at odds with the rest of the financial world ?

Last May 2012, the Swiss National Bank (SNB) intervened to support the minimum exchange rate of 1.2000 Swiss francs to one euro, to the tune of 60 billion Swiss francs ($66 billion).

This means that the SNB is spending, on average, the equivalent of $7 million per minute to support this arbitrary quota.

An absolutely staggering, not to mention absurd, figure.

Can the SNB keep up this pace for long?

The risks for the country (and especially for the SNB) of eating into its balance sheet and having to record large capital losses that are not sustainable at this time are really high.

I also believe that the US Federal Reserve, the Bank of Japan and especially the European Central Bank have already officially asked the SNB not to maintain such a devalued exchange rate for much longer.

Moreover, the negative interest rate for the CHF (currently -75 basis points) is in danger of becoming uncontrollable.

Incidentally, in 1999, the very head of the Swiss National Bank published a very thorough study on a possible peg of the EUR/CHF exchange rate.

He called it “impractical”, “highly speculative”, and “concomitant with an excessive inflow of foreign capital into Switzerland”.

Exactly what has been happening for months….

I repeat again.

The day the peg is removed, or when it gives way, we will see a thud of the EUR/CHF exchange rate that will go down in history.

An unprecedented free fall.

Like in a movie.

January 16, 2015

Famous last words

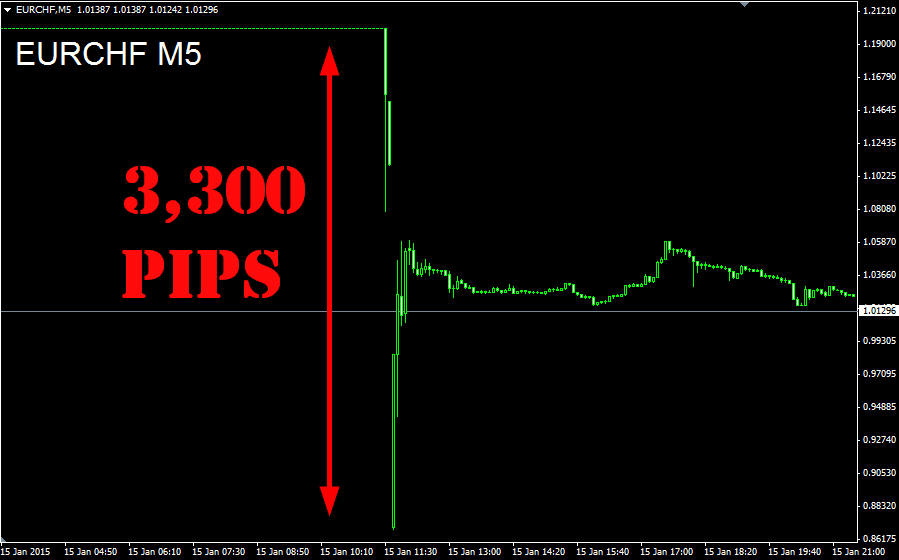

The Swiss National Bank (SNB) has shocked the global financial markets with its decision to abolish the minimum exchange rate of 1.20 CHF to EUR, which has been in place for three years.

The news, which was completely unexpected, caused an unprecedented collapse in a very short period of time.

The rate went from 1.20 to 0.79 in less than 10 minutes.

Of course, many believe that with an appropriate and very tight stop loss, most traders (including almost all major global financial institutions) would not have suffered such catastrophic losses.

However, in a move as volatile and sudden as this, the market really has no way of immediately absorbing such a large number of sell orders.

Simply because of the lack of available liquidity.

Take a look at the chart above.

Between 1.10 and 0.98, there was no buy suggestion in the book.

Nothing.

Because of this sudden and unexpected move, my broker at the time lost a fortune, about $120 million.

I, as a small businesswoman, won an infinitesimal part of it, an amount with which I started my own small trading company the following year, which I still run today.

From then on, the broker did everything he could to make my life more and more difficult.

From cyber attacks on my trading platform to more and more pressing “bureaucratic” problems.

Until I was practically forced to close the account I had with them for over ten years.

The “big boys” do not like any interference in their business.

They have to make a profit all the time.

In their logic, retail customers are just a source of profit.

And if one of the so-called “unwashed big boys” dares to be smarter, the crackdown begins immediately.

The market must be “free”.

But only if they are the only ones making money.