November 15, 2024 Trading notes

A man was to fight a duel the following day.

His second asked him : “Do you shoot well ?”

“Modestly, I can hit the stem of a goblet from fifteen yards”, replied the duelist.

“Very well,” replied the second, not at all impressed.

“But can you hit the stem of the wine goblet while pointing a loaded gun straight at your heart ?”

My personal trading rules. A good system and proper money management

Finally, I decided to share some thoughts on “Trading and Surviving in the Financial Markets”.

On the other hand, I have spent most of the last twenty-four years in contact with the global financial markets.

I have been working on Wall Street and the global financial markets since April 2000.

At the beginning of my career, I was a big scalper : exchanges like the Nasdaq and Xetra were my daily playground.

Derivatives were relatively new at the time, and I was part of it.Later, I began to study the science of designing a trading system.

It worked out well, but it was certainly not an easy road.

For this reason, I have studied most of the systems, trading approaches and strategies of the so-called gurus with whom I have often interacted.

Sometimes just out of curiosity.

Other times because I was looking for confirmation of my personal strategies.

I studied programming and developed my own software over the years.

I explored most possible trading strategies, even simulating possible different trends through the use of artificial intelligence.

I really like the markets.

I like the interconnectedness of them.There was a time when I would wake up in the morning and think, “What can I do today to make some money in the market?”

Then there was a rough patch where I thought, “Maybe I should do something else for a year or two.Then one day I read this quote: “I always look for patterns and trends in everything.

Following an initial trend from the beginning is an exercise in observing and responding to the present moment”.

And so I finally figured out how to survive in this jungle.

There is no magic indicator or artificial intelligence system capable of correctly predicting the sequence of events influenced by too many situations, and perhaps there never will be, although very important financial institutions such as BlackRock are investing hundreds of billions of dollars in it.

It is necessary to make the right decisions by following your own trading system.

A highly customized model.

A customized model, like an evening gown made by a designer.

This is the only really effective approach.

For a novice, mastering the global financial markets without proper preparation and constant study is much worse than going to the casino.

At least at the casino, you lose in good spirits, drink a cubalibre, wander among the tables, enjoy the spectacle of gamblers, croupiers and those playing slot-machine or black-jack.

To become a true dealer, however, one must first embark on a long inner journey.

To really know yourself to the core.

But introspection, if not well managed, can become a devouring monster.

Introspection needs a lot of material, experience, knowledge, contacts, experiences and places.

And eventually it stops feeding.

State of Mind

Calmness and humility are the ideal states.

Ego and stress are your worst enemies.

The market is always neutral ; it doesn’t care if you win or lose.

In trading, the enemy is you.

The first step is to understand that every victory is temporary.

Never let your guard down.

Stress Factors and Anxiety

Identify and eliminate sources of stress.

This simply means that something in your method does not suit your personality.

Possible stressors include high positions or nervousness due to external factors.

The Market

Once you have defined your strategy (and set stop losses), do not monitor your position.

Constant market fluctuations cause anxiety, loss of clarity, impulsive decisions and (of course) mistakes.

Watching the market intraday causes you to constantly change your mind as the situation evolves, increasing stress and uncertainty.

Size of open positions and trading units

Gradually increase the positions, just like lifting weights in the gym.

If the size of the open position makes you uncomfortable, it means it is too large.

Reduce it.

After a negative series, you may suffer from a loss of self-esteem, which can make you less clear-headed.

Focus on your mistakes and, if necessary, halve the size of your positions.

If you feel too euphoric after a very positive series, take a break for a while and rest.

Euphoria leads to arrogance and underestimation of risk.

The desire to increase the size of your position beyond the set level is the first sign of euphoria.

Trading Strategy

When trading, focus only on executing the plan correctly.

Try to do the right thing according to your method and do not focus only on profit.

A profit is nothing more than the result of a series of correct actions.

Losses

To err is human.

The important thing is the overall result as long as you continue to follow your method.

Intuition

Intuition is simply that part of experience that resides in the subconscious mind.

The secret is to understand the difference between what you want to happen and what you know will happen.

If you give up your ego and defend your initial opinion at all costs, and instead listen to what the market is whispering to you, you will gain a lot of useful information.

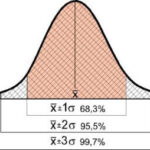

Hope, Fear and Probability

Success in the markets is all about mastering the calculus of probability.

One must focus exclusively on what will actually happen.

Hope and fear prevent you from correctly assessing the probability of an event.

As soon as the idea that you have discovered a favorable trade crosses your mind, hope takes over.

The mind tends to give more weight to supporting factors and underestimate opposing factors.

Fear, on the other hand, overestimates the unfavorable factors and pushes you out of a good position too soon.

Compliance minimizes the negative influence of hope and fear.

This is because you feel more confident and already know what to do and when to do it.

Follow your rules, not your opinions.

Otherwise, when you should be bold, you will be afraid, and when you should be cautious, you will be brave.

Pandora’s Box

According to Greek mythology, the vase was a gift from Zeus to Pandora, who told her not to open it.

But Pandora, who had received the gift of curiosity from Hermes, could not resist the temptation and opened the vase, unleashing all the evils of the world.

So, at the bottom of the vase, only hope remained…

The statistics speak for themselves.

90% of traders burn 90% of their capital in the first 90 days.

Among them are people who are very successful in their profession.

However, when they trade, they suddenly lose their mind.

I think there is a hidden addiction to gambling.

Or arrogance and conceit, which in other fields of work can sometimes bear fruit, but in the financial markets are often the antechamber of tragedy.

The various trade fairs (I haven’t visited them for at least 20 years) seem like a fair to teach gambling.

There are confused people looking at the book without even knowing what a bid-ask spread is.

Or people struggling to understand the leverage they are using.

Retirees who want to make a quick profit on their liquidation.

Young people who use derivatives exclusively but do not know how to calculate a simple percentage.

People who invest in the markets as if they were in a casino.

I could go on and on with this list of horrors.

How is it possible that these people do not lose almost everything ?

Excessive mythmaking

A few months ago I happened to read Storia di un ex-tifoso.

A book that piqued my curiosity for several reasons.

First of all, I knew the author, Massimo Camiciottoli, personally during the now – unfortunately – distant years when we were classmates in high school.

Then the subject : his 20 years of experience as a die-hard fan.

A long and deep reflection followed.

“Cheering” is nothing more than a fictitious and contrived connection to something completely alien to us.

Above all, it brings no personal satisfaction.

As opposed to a sporting discipline that is practiced personally.

In my opinion, the same concept is fundamental for those who aspire to become traders.

Especially for those who want to try their hand at this discipline in a highly professional manner.

Going back to my personal experience, in the early years of my career I definitely idealized market wizards in general.

But it is necessary to have your own style.

One should not imitate the methods already used by others.

Because, I repeat, trading must be rewarding first and foremost on an emotional level.

One must not focus exclusively on profit.

Profit is nothing more than the consequence of a series of correct actions.

Hic sunt leones !

At the time, several commenters on that Jurassic (2004!) post accused me of arrogance and conceit.

But in an ironic way, I was simply recounting the typical day you never have to face in the market, inspired by a semi-serious post I found on the Internet a few weeks earlier.

Wake up and turn on the radio or TV. Or, in bed, consulting the smartphone (which did not exist at the time!).

Following any news, even the most unlikely.Consult forums with the intention of finding a bright idea to make money easily.

Paying undue attention to macroeconomic data. In the vast majority of cases, it is just background noise.

Too much information (a concept I will repeat over and over again) only hurts.

It only creates enormous confusion.

And it only serves to “justify” your mistakes.

With the result that you become more and more nervous.

In addition, it is important not to bring the difficulties you encounter in the marketplace into your relationships with others, especially with your partner.

Even if things are not going well at the moment.

Money is earned over time.

What is needed ?

A good trading system correlated with good money management.

In short, detachment is required.

16 October, 2004

The clock radio, tuned to Radio 1, says good morning.

It’s 7:35 a.m. and Money Matters (Questione di Soldi) is on.

Still half asleep, you strain your ear to catch the words.

“Good closing Nikkei, with the Japanese index up xx%.”

The reporter tells you in a reassuring voice that the Asian markets closed up.

You get up in a good mood and go to the bathroom, where another small radio comes on as soon as you pick it up.

The expert with the anonymous last name reminds you that investing in a stock fund will only pay off in the long run, 10 to 15 years.

In fact, your fund is down 43.6 percent from the time you bought it in March 2000.

In a moment you see yourself projected into the future.

2013-2015.

You are finally earning 2.35 percent.

Before you go into the kitchen, you can’t help but stop by the living room and turn on the TV, which is tuned to Bloomberg TV.

And you find out that the Nikkei is down 2.64 percent and all U.S. futures are negative.

You get angry and wonder why Rai systematically gives the wrong Nikkei in the morning.

Maybe they get the one from the day before from Teletext.

You rush out of the house.

Your only goal now is one.

Your only goal is to get to the office by 9:00 a.m., turn on your computer, and log on to your platform in time for the opening.

Work doesn’t even cross your mind while you’re at your desk.

Piazza Affari3 opens strangely well.

You check your schedule and find that you have no special commitments or meetings.

You are free to act.

Yes, you finally learned your lesson.

No more stocks in the drawer.

You’ve already accumulated quite a few and are losing an average of 70 percent.

Only day trading.

That’s how you trade the stock market.

But you have no idea what to buy.

So you log on to the forum, hoping to get some tips.

There are really knowledgeable people there.

In a matter of seconds, they go long, short, long again, and then short again with science-fiction-like skill.

You kind of envy them and wonder what platform they use.

Your platform takes more than two minutes just to get to the login screen.

Not to mention the execution of an order.

Finally, round and round, you buy the usual stock.

You don’t get the execution in time because the phone rings.

It’s your boss.

You leave the Mibtel at +0.78%, your stock at +1.75% and go up.

You get caught up in a three-hour meeting.

When you return to your desk, you find that the Mibtel has lost 1.07% and your stock has lost 2.75%.

You frantically try to figure out what happened.

Finally, you find out that at 11:00 a.m., a well-known investment bank downgraded a sector.

The very sector in which your stock is rated.

The very sector in which your stock is rated.

And so, inevitably, the bids started all over the marketplaces.

That’s the second upset of the day, as you think that maybe you should have applied the stop loss.

But the usual doubts assail you.

What if Wall Street…

So you decide not to apply the stop loss and wait until 15:30.

But Wall Street opens poorly and continues to deteriorate.

You finally work up the courage and sell at 15:55.

A loss of 4.83%.

But you’re a moron.

You forgot that the macroeconomic data are about to be released at 4 pm.

This data is very positive.

Within minutes, all indexes are in the green.

Then you try to jump back in.

But your platform is very slow.

By the time you log in, your stock is already up +2.27 percent.

You give up and go back to the beginning of the year.

37 trades in loss and 4 in profit.

The latter are the only ones that count.

They make you believe that you can make money in the stock market.

All you have to do is perfect the method.

Before you leave the office, connect to the forum again.

Almost everyone made money and had a good time.

It was a great day, made special by the high volatility.

You, on the other hand, are angry.

You slip into a few posts, insult a few people, and leave.

At home, your wife is waiting for you.

She loves you and doesn’t say anything to you anymore.

She just hopes that the Nasdaq closes at +4% or that a new bull market starts.

She is hoping that the sweet man she is madly in love with will be by her side again.

And she says good night while watching Bloomberg TV waiting for New York to close.

She leaves quietly.

And you start zapping systematically, waiting for 1:00 a.m., the opening time of the Nikkei…